- Support portal

- Evaluation Kits and partner products

u-blox Support

- Product documentation

Documentation

- Investor relations

Investor relations

Tech

|

28 Jul 2023

Toward ubiquitous coverage for the IoT

Terrestrial cellular connectivity is present in large cities and regions with less human presence. This, however, accounts for a limited portion of the globe. The reason is twofold. On the one hand, many countries have uneven coverage. On the other hand, terrestrial cellular connectivity is absent from vast remote regions such as oceans, mountains, or deserts.

Consequently, numerous enterprises have turned to non-terrestrial satellite connectivity to fill coverage gaps and ensure global tracking and monitoring of their most valuable goods and assets. For instance, this is the case for the asset tracking, logistics, and transportation segments. Still, it could also be beneficial for markets such as remote control of critical infrastructures and smart agriculture.

Until recently, the IoT satellite communication ecosystem was limited. 80% of the subscriber base was in the hands of a few companies, and the entry barriers were, to say the least, more than challenging. In the past few years, however, the satellite IoT communications market has garnered significant attention, with heavy investment flows, new start-ups, and the launch of new satellite constellations.

Moreover, established companies and large corporations previously showing little interest are now eager to join the IoT satellite connectivity market. In the near future, at least ten satellite providers plan to deploy satellite communication services to further the development of satellite connectivity.

Let us then take a closer look at the drivers behind this trend, the origins of the technology, and the role of non-terrestrial connectivity for cellular communication.

Satellite connectivity occurs via satellite constellations. It is characterized by different orbits, frequency bands, bandwidth, latency, and both standard and non-standard communication protocols.

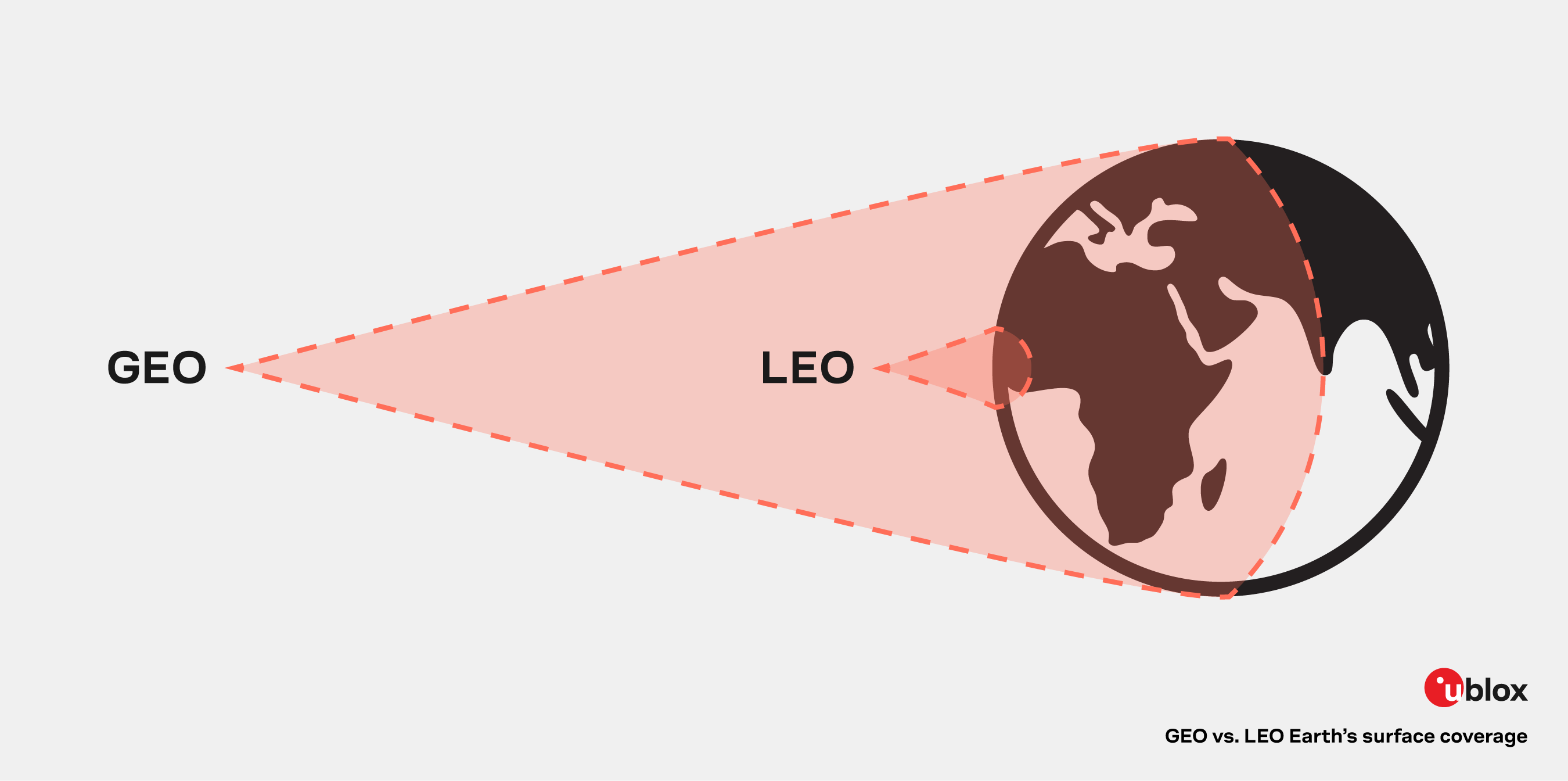

The orbit is critical as it influences size, cost, and latency. The most common orbit options for IoT use cases are the Geostationary Earth Orbit (GEO) and the Low Earth Orbit (LEO).

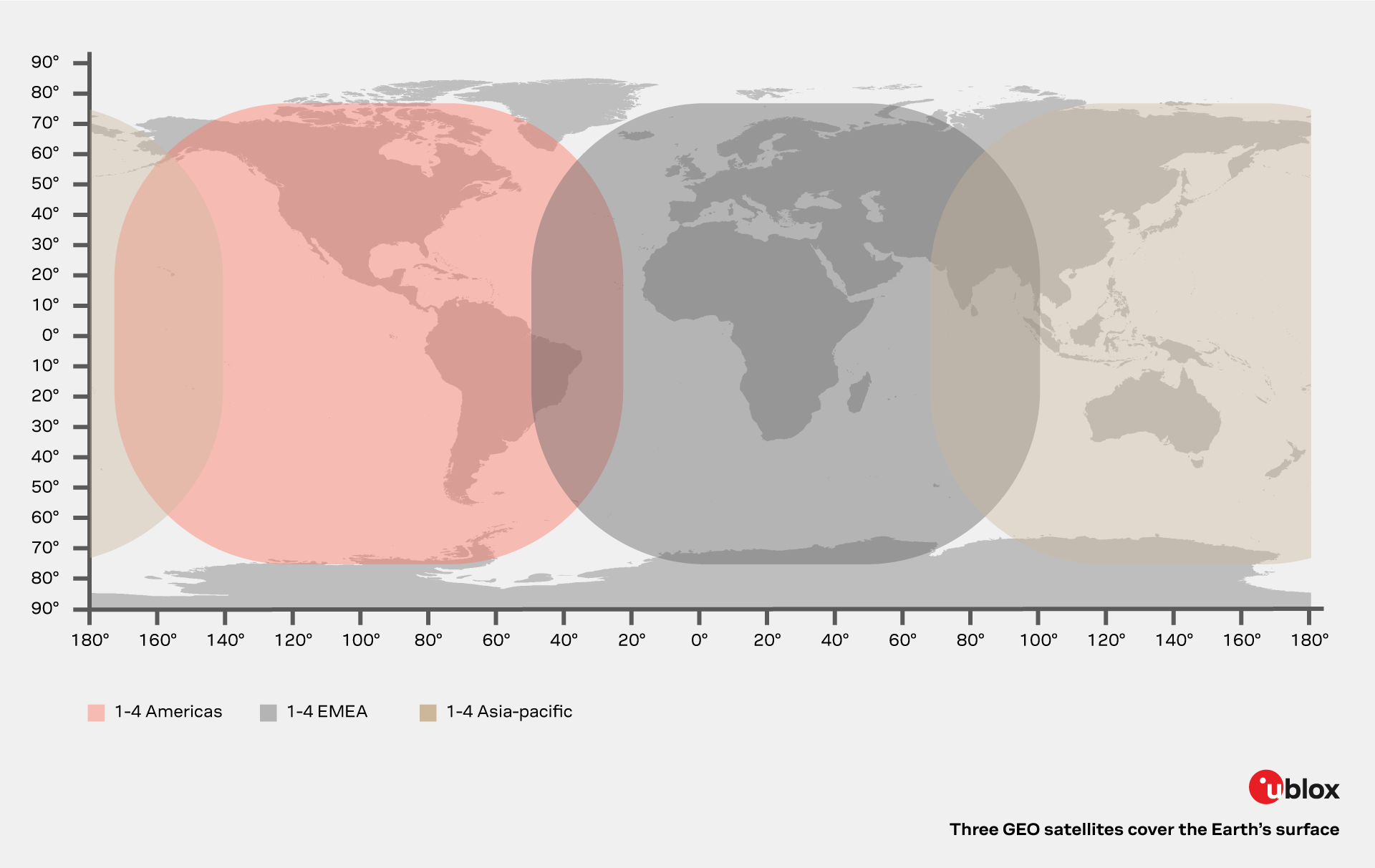

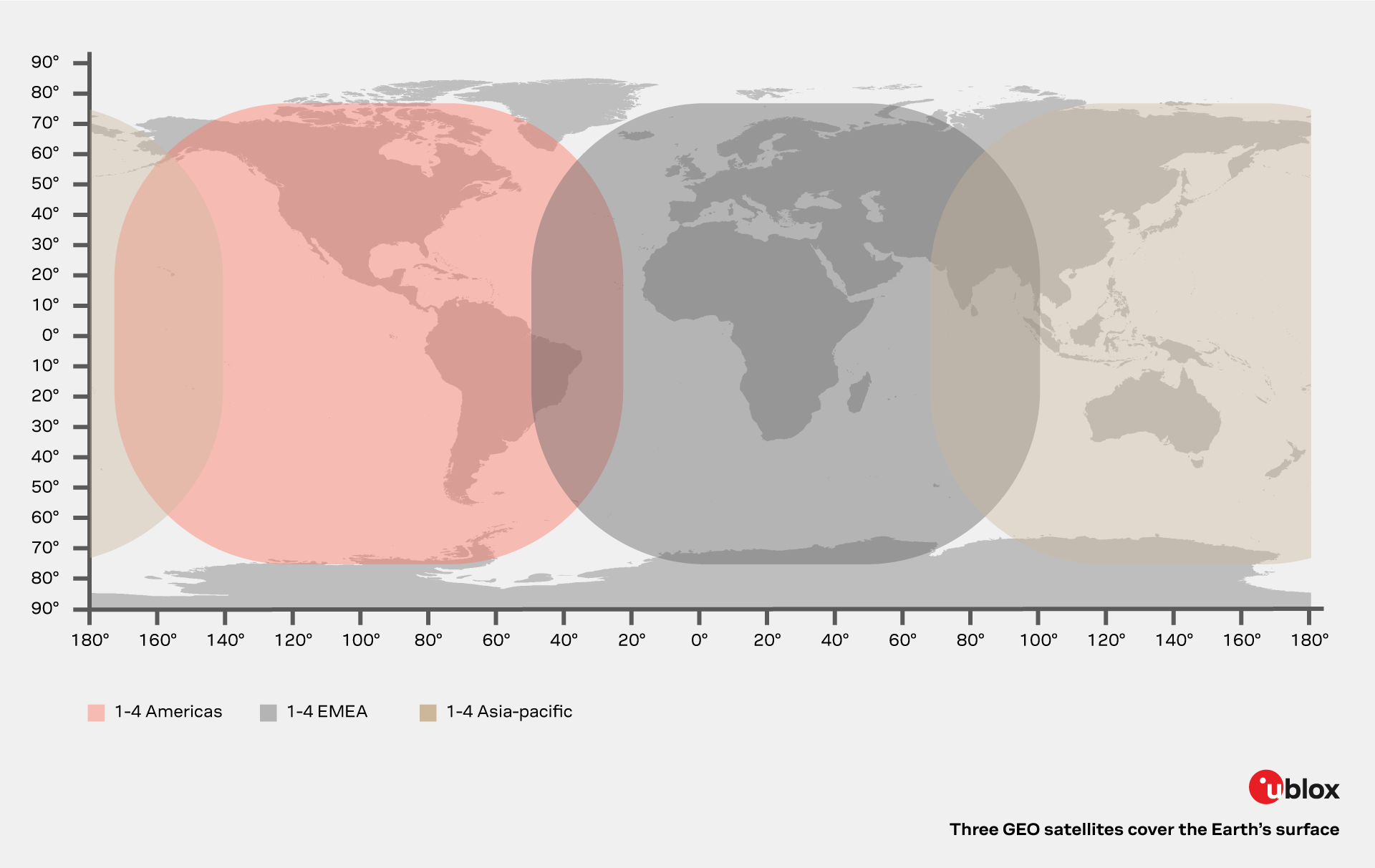

Historically, most telecommunication satellites are of the GEO variety, orbiting at some 36,000 km from the Earth’s surface. The Earth and these satellites rotate at the same speed. In theory, three GEO satellites can cover most of the globe.

Some disadvantages to establish satellite connectivity via a GEO satellite are the costs of manufacturing, launch, and release of the satellites, which are higher than in the LEO’s case. Latency is the other main disadvantage. Due to their distance above the Earth’s surface, latency can be up to several seconds, even for a limited data packet size.

A device that uses a GEO constellation must have enough RF output power to reach 36,000 km of altitude. This fact translates into a more complex RF chain and the need for an antenna with more gain. Still, the application does not require antenna steering or complex control since GEO satellites are stationary from the device's viewpoint.

LEO satellites, on the other hand, orbit between 400 and 1,500 km from the Earth’s surface. LEO has become increasingly popular thanks to the so-called cubic satellites: space vehicles of about 10 x 10 x 10 cm built with off-the-shelf technology. These cubic satellites are lower cost to produce and can travel toward space as a secondary payload in rockets carrying bigger satellites. The method is highly convenient as it minimizes launch costs.

Another aspect that reduces costs and makes this a popular approach is the communication cost, which is significantly lower in this orbit. Since the satellite is closer to the Earth’s surface, communication requires less radio power as the attenuation is lower. Less RF power translates into less sophisticated equipment like smaller solar panels.

For these satellites, latency is negligible due to the short distance. However, good connectivity will depend on the compensation of the Doppler effect, a consequence of the satellite’s relative orbital speed.

A LEO satellite flies at about 7 Km/s. For this reason, a user on the ground can see the LEO satellite only for a brief period. Specifically, a user has a visibility window that lasts approximately seven to ten minutes before the satellite disappears. Since LEO satellites are not continuously visible, constant connectivity requires a constellation of tens of interconnected LEO satellites.

Another aspect to consider is that LEO satellites fly over the user. So, from the user’s perspective, it is mandatory to:

Today, IoT applications that need ubiquitous connectivity must rely on terrestrial cellular networks and classic IoT satellite communications. Nevertheless, from an operational point of view, to keep cellular and satellite connectivity active is not a usual option, as power consumption and non-terrestrial connectivity imply extra costs. For this reason, manufacturers should design products that address the switch between both networks.

The switch between technologies will depend on the circumstances. Cellular connectivity should be the basis of communication since satellite connectivity is more expensive and, depending on the type of constellation used (LEO and GEO), it offers less bandwidth and does not provide real-time capabilities. Instead, satellite technology will compensate for the absence of a terrestrial cellular network; it acts as a backup and provides satellite communication services when cellular connectivity is unavailable.

Three tangible instances where a switch would be beneficial are the following:

Of course, the design of solutions plays a role, which depends on the type of application.

Applications with access to cellular and satellite connectivity usually require a dual-mode design. Although those dual-mode cellular-satellite devices are more expensive than cellular-only, they remain necessary for some applications. In the following examples, cellular and satellite connectivity could interact hand in hand.

Containers. During the pandemic wave, many containers were abandoned due to fewer crew members in the ports or available drivers to move them. This led to a shortage of raw materials in early 2020, with an additional impact on the supply chain. Some containers had connectivity, but most were lost somewhere for an extended period, which significantly slowed the coordination process.

Fixed use cases. Critical infrastructures like oil or water pipelines in deserts or mountains need continuous monitoring, but cellular connectivity alone cannot ensure 100% coverage. Satellite connectivity could play a key role in case of events that require immediate action, for instance, leakages.

Smart agriculture. In this case, cellular connectivity is subject to drops due to the lower density of the base stations. This is a growing market, and regions with vast agricultural areas are only partially served by cellular connectivity.

Developed countries such as US and China cannot guarantee 100% cellular coverage outdoors. One clear obstacle is that Mobile Network Operators (MNOs) do not spend enough money to bring connectivity where the population density is extremely low, like in isolated areas. Satellite IoT would therefore play a vital role in these markets as well.

Satellite communication was born in the 1960s, while cellular technology was designed ten years later. Until 3GPP Rel.17, their coexistence or integration was uncommon. But with the several new constellations that support the IoT Non-Terrestrial Network standard (IoT-NTN) ready for deployment and propelled by the COVID crisis and an increase in affordability, IoT SAT connectivity is finally about to take off.

Many satellite constellations today provide satellite communication services via proprietary protocols and IoT connectivity, primarily based on the GEO or LEO constellations. The design of an application capable of ubiquitous connectivity means integrating cellular connectivity with one of these satellite solutions. To appeal to the IoT industry, this should occur in a cost-optimized way based on sharing hardware components.

Today’s challenge is that the IoT-NTN ecosystem is still nascent and awaits full deployment. For this to happen, it will require new IoT terminals, new satellite constellations, and roaming arrangements between satellite providers and cellular MNOs. Still, some applications must fulfill unique needs, and the only way to do so is to merge the available technologies.

Satellite IoT connectivity will become a standard part of the IoT ecosystem in the near future, becoming especially powerful when combined with established terrestrial cellular technology. The standards, regulations, and the IoT ecosystem are clearly moving forward in this direction. With this premise, IoT designers must be ready to ride the wave as a huge market will rely on this emerging capability. The final question is, are you prepared for satellite connectivity?

Valerio Carta

Senior Product Marketing Manager Cellular